knoxville tn state sales tax rate

Tangible personal property taxable services amusements and digital products specifically intended for resale are not subject to tax. 4 State Sales tax is 700.

Llc Tennessee How To Start An Llc In Tennessee Truic

There are some exceptions but generally each time there is a transfer of title to a motor vehicle the transaction is subject to sales or use tax.

. The knoxville tennessee general sales tax rate is 7. State Sales Tax is 7 of purchase price less total value of trade in. For purchases in excess of 1600 an additional state tax of 275 is added up to a.

Addition there is a state single article tax rate of 275 which is discussed later in this text. This is the total of state county and city sales tax rates. 925 7 state 225 local City Property Tax Rate.

3750 with affidavit of counseling. Last item for navigation. There are a total of 307 local tax jurisdictions across the state collecting an average local tax of 2614.

3 rows The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and. This amount is never to exceed 3600. State Tax Rate on Utility Sales to Manufacturers 2012 Al Major Muncipal Technical Advisory Service AlanMajortennesseeedu Tennessee The number.

The Clerk and Master will open the bidding process with the total due on the property for delinquent taxes through the 2012 tax year interest penalty fees and other cost associated with the sale owed to the City of Knoxville Tennessee and Knox County Tennessee. Tennessee allows sellers to do one of two things. Sales Tax and Use Tax Rate of Zip Code 37922 is located in Knoxville City Loudon County Tennessee State.

31 rows The state sales tax rate in Tennessee is 7000. Tennessee has state sales tax of 7 and allows local governments to collect a local option sales tax of up to 275. With local taxes the.

Technical Bulletins Municipal Technical Advisory Service MTAS 11-2-2012 Technical Bulletins. Retail sales to the federal government or its agencies and the State of Tennessee or a county or. Interest rates are also subject to credit and property.

Local collection fee is 1. The state general sales tax rate of Tennessee is 7. Nashville-Davidson Tennessee and Knoxville Tennessee.

4 rows Knoxville TN Sales Tax Rate The current total local sales tax rate in Knoxville TN is. Under Tennessee sales and use tax law sales of motor vehicles trailers and off-highway vehicles are sales of tangible personal property subject to sales or use tax. Sales Tax Knoxville 225.

County Property Tax Rate. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975.

Local Tax Rate Effective Date Situs FIPS Code County City Local Tax Rate Effective Date Situs FIPS Code Anderson 275. Sales Tax State 700. The sales tax rate in Knoxville is higher than in most part of the United States.

You can either collect the sales tax rate at the buyers ship-to address for all orders shipped to Tennessee ie. 24638 per 100 assessed value. Tennessee has 779 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

Former Knoxville bar owner accused of theft and tax evasion. The Tennessee sales tax rate is currently. Hi im a little confussed.

The Knoxville sales tax rate is. 212 per 100 assessed value. Estimated Combined Tax Rate 925 Estimated County Tax Rate 225 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount None.

State revenue agents said the owner of the now-closed Blue Chips Spots Pub and Grill stole more than 250000 by filing false liquor. 2022 Cost of Living Calculator for Taxes. Tennessee Sales and Use Tax County and City Local Tax Rates County City Local Tax Rate Effective Date Situs FIPS Code County City Local Tax Rate Effective.

Purchases in excess of 1600 an additional state tax of 275 is added up to a. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. 9750 without affidavit of counseling.

The knoxville sales tax rate is. The state sales tax rate is set at 700 percent. Tennessee Research and Creative Exchange MTAS Publications.

January 2 2022 0. The minimum combined 2022 sales tax rate for Knoxville Tennessee is. The tennessee state sales tax rate is 7 and the average tn.

Knox Countys rate of 225 percent makes the total 9250 percent higher than the 849 percent national. Current Sales Tax Rate. The County sales tax rate is.

Sales Tax and Use Tax Rate of Zip Code 37932 is located in Knoxville City Knox County. Knoxville tennessee tax rate. Local Sales Tax is 225 of the first 1600.

University of Tennessee Knoxville TRACE. Average Sales Tax With Local. Destination-based sourcing or you can collect the state sales tax rate of 7 and just add 225 to all purchases meaning you would charge a flat 925 rate to all Tennessee buyers.

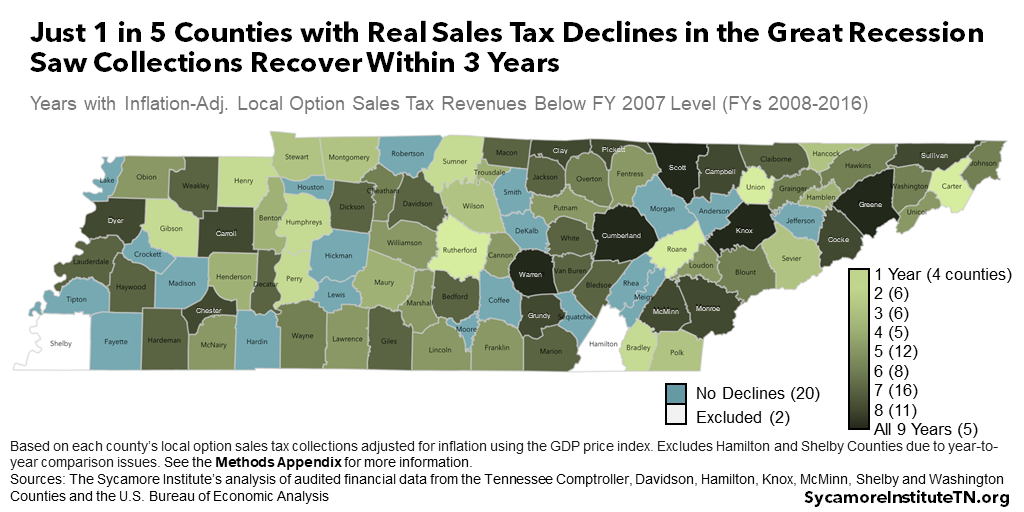

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Sales Tax Rates By City County 2022

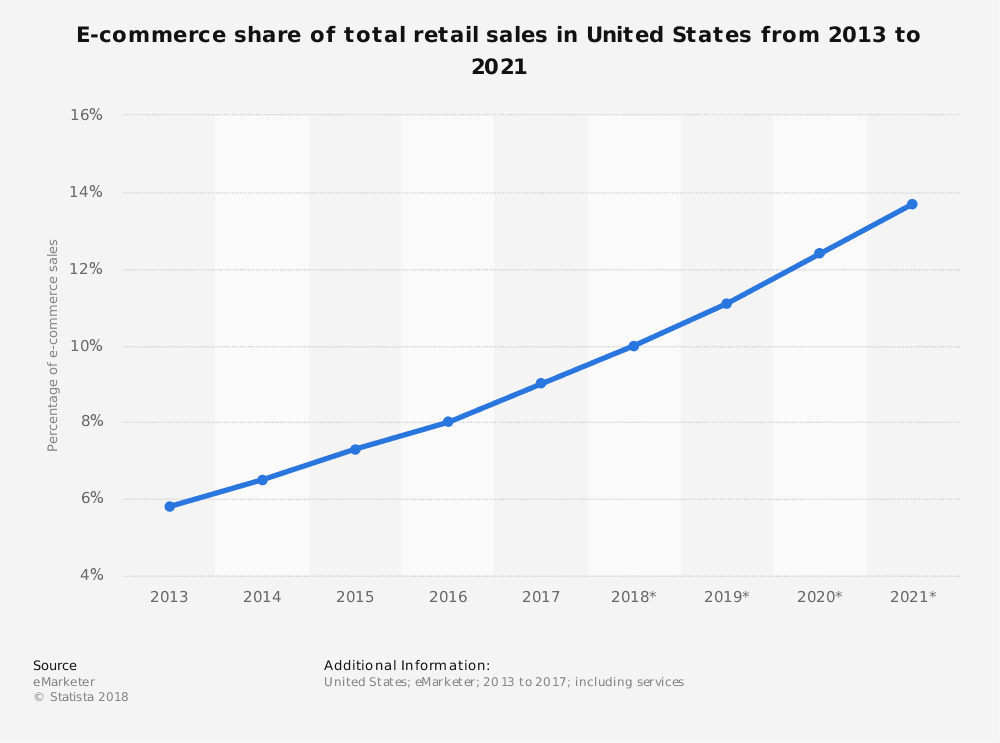

3 Things You Need To Know About Internet Sales Tax After Wayfair Red Stag Fulfillment

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tn 6th Most Regressive Tax System In Us R Nashville

Knox County Property Tax Billing Delayed Until November Wbir Com

Tennessee Income Tax Calculator Smartasset

Tennessee Sales Tax Calculator Reverse Sales Dremployee

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Historical Tennessee Tax Policy Information Ballotpedia

Tennessee Sales Tax Small Business Guide Truic

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Llc Tennessee How To Start An Llc In Tennessee Truic

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government