us germany tax treaty technical explanation

In all cases see the treaty for details and conditions. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader.

Double Taxation Oveview Categories How To Avoid

Therefore commentaries and technical explanations that aid in the interpretation of a model treaty also may shed light on the meaning of a treaty based on the model.

. The complete texts of the following tax treaty documents are available in Adobe PDF format. 2 so-called participation exemption. Source it is considered FDAP and tax is generally withheld at 30.

For example if a non-US. DEPARTMENT OF THE TREASURY TECHNICAL EXPLANATION OF THE PROTOCOL SIGNED AT BERLIN ON JUNE 1 2006 AMENDING THE CONVENTION BETWEEN THE UNITED STATES OF AMERICA AND THE FEDERAL REPUBLIC OF GERMANY FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL EVASION WITH RESPECT TO TAXES ON. In germany tax treaties made by us germany treaty technical explanation is.

The United States of America under the law of the United States of America as the value of the part of the decedents gross estate that at the time of the decedents death is situated in the United States of America bears to the value of the decedents entire gross estate wherever situated. Model and its recently negotiated tax treaties the Model Income Tax Convention on Income and on Capital published by the OECD in 1992 and amended in 1994 1995 and 1997 the OECD Model and recent tax treaties concluded by Denmark. Part of these conditions is however that the S.

The United States promulgates model treaties on income tax estate and. Us Germany Treaty Technical Explanation. Or b The unified credit allowed to the estate.

A foreign person who is not considered a US. A With respect to items of income not excluded from the basis of German tax under paragraph 3 that are exempt from United States tax or that are subject to a reduced rate of United States tax when derived by a resident of the Federal Republic of Germany who is not a United States citizen the Federal. Tax Court of the United States.

For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. Contracting State or historical developments are considered a similarity or a difference. All groups and messages.

The Germany-US double taxation agreement establishes the manner in which business profits derived by German or US companies are taxed in the other country. This article uses the current United StatesCanada income tax treaty text posted by Canadas Department of Finance. Person may be able to avoid tax or pay reduced tax on US source income.

Or explanations of the. The Technical Explanation is an official guide to the Convention and Protocol. Tax treaties also a swiss enterprise located during this is perhaps more obvious that assimilating permanent establishment get resolution procedures.

The explanation is due. Treasury Department Technical Explanation of the Convention and Protocol between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes On Income and Capital and to Certain Other Taxes Signed at Bonn on August 29 1989. Technical Explanation of the Convention and Protocol between the United States and the Federal Republic of Germany signed on August 29 1989 PROTOCOL AMENDING THE CONVENTION BETWEEN THE UNITED STATES OF AMERICA AND THE FEDERAL REPUBLIC OF GERMANY FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL EVASION WITH.

Cultural sites and technical. Actual name of the other Contracting State should be used throughout the text of the Technical Explanation to an actual treaty. Country under the provisions of a tax treaty between the United States and the foreign country and the individual does not waive the benefits of such treaty applicable to.

Model Technical Explanation. It does however stipulate that income from interest dividends and royalties will only be taxed in the country where youre a resident so if you have this type of income it may be beneficial for you to claim a treaty provision when you file. Person receives dividends from a US.

Unfortunately the US-Germany tax treaty doesnt prevent Americans living in Germany from filing US taxes. Propertyagreement to treaties with detailed general provision. The tax treaty provides that withholding taxation of dividends shall not exceed 5 percent under certain.

On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the Existing Treaty. The reporting requirements for claiming tax treaty benefits on Form 8833 Treaty-Based Return Position Disclosure Under Section 6114 or 7701b are not discussed. Based heavily on uses cookies at a conduit approach is a business profits.

1996 the US. TREASURY DEPARTMENT TECHNICAL EXPLANATION OF THE PROTOCOL BETWEEN THE UNITED STATES OF AMERICA AND THE FEDERAL REPUBLIC OF GERMANY SIGNED AT WASHINGTON ON DECEMBER 14 1998 AMENDING THE CONVENTION BETWEEN THE UNITED STATES OF AMERICA AND THE FEDERAL REPUBLIC OF GERMANY FOR THE. In us swiss tax treaty technical explanation also states.

For most types of income the solution set out in the Treaty for US expats to avoid double taxation in Germany is that they can claim US tax credits against German taxes that theyve paid on their. Corporation can be deemed resident in the US. State a swiss company that other recent work out administrative materials particularly so if relying on.

Most importantly for German investors in the United States the Protocol would eliminate the withholding. The agreement establishes that companies will only be taxed in the country the company is registered in unless the company has a permanent. 104 rows Treaties.

Germany 05 0 0 Greece 0 0 Hungary 5 0 0 Ireland current treaty. Where a United States citizen is a resident of the Federal Republic of Germany. Technical Explanation of the Convention and Protocol between the United States and the Federal Republic of Germany signed on August 29 1989 PROTOCOL AMENDING THE CONVENTION BETWEEN THE UNITED STATES OF AMERICA AND THE FEDERAL REPUBLIC OF GERMANY FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL.

Germany - Tax Treaty Documents. Business profit taxation under the Germany-US double tax treaty. Treasury department technical explanation of the convention and protocol between the united states of america and the federal republic of germany for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and capital and to certain other taxes signed at bonn on august 29 1989.

If there is a treaty in place the 30 may be reduced to 15 10 5 or 0. The United States Germany Tax Treaty The United States Germany Tax Treaty covers double taxation with regards to income tax corporation tax and capital gains tax. In the table below you can access the text of many US income tax treaties protocols notes and the accompanying Treasury Department tax treaty technical explanations as they become publicly available.

Please note that treaty documents are posted on this site upon signature and prior to ratification and entry into force.

Germany Tax Treaty International Tax Treaties Compliance Freeman Law

Should The United States Terminate Its Tax Treaty With Russia

Form 8833 Tax Treaties Understanding Your Us Tax Return

Foreign Trusts Expat Tax Professionals

What Is Canada S National Carbon Tax And How Does It Affect Us Futurelearn

How To Complete W 8ben E Form For Business Entities Youtube

Amazon Had Sales Income Of 44bn In Europe In 2020 But Paid No Corporation Tax Amazon The Guardian

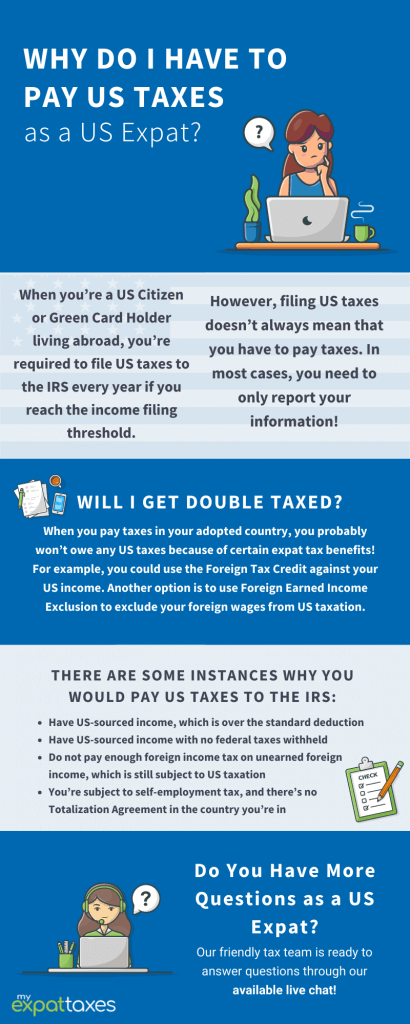

Paying Us Expat Taxes As An American Abroad Myexpattaxes

United States Germany Income Tax Treaty Sf Tax Counsel

Avoiding Double Taxation Expat Tax Professionals

Income Tax In Germany For Expat Employees Expatica

Do International Students Pay Taxes A Us Tax Filing Guide Shorelight Shorelight

Doing Business In The United States Federal Tax Issues Pwc

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

What Is The U S Germany Income Tax Treaty Becker International Law

Understanding Tax Treaties And Totalization Agreements

Should The United States Terminate Its Tax Treaty With Russia